Gold Prices Could Be Headed Much Higher

It’s important to understand what’s happening in the gold market. Gold prices you see now, may not be here for too long. The yellow precious metal could really soar.

You see, over the last two years, gold prices have done exceptionally well. In 2016, the yellow precious metal increased by 9.1%. Then, in 2017, it appreciated by another 13.6%.

Year-to-date, gold prices have increased roughly 3.8%.

Here’s the thing; all of this has happened on the back of little to no uncertainty.

If you looked at the investors’ sentiment indicators over the past few years, they all have been pointing toward one thing: investors are not scared at all.

What Happens to Gold Prices When Uncertainty Soars?

Now, it has to be questioned, what will happen to gold prices once investors actually become scared? Remember, gold is usually considered a safe haven. In times of uncertainty, investors run toward it.

Are there any reasons for investor sentiment to change?

Yes.

As it stands, stock markets are trading at extreme valuations relative to historical averages and there’s a significant amount of complacency among stock investors and advisors. This is never a good combination to have. In simple words, a stock market crash could be ahead.

When you look at bonds, they are facing a lot of headwinds. You could thank the Federal Reserve for this. Basic economics: As interest rates go up, bond prices go down and their yields increase.

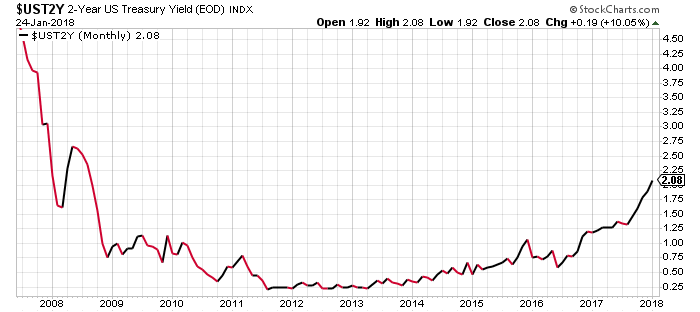

To give you some idea, look at the yields on the two-year U.S. Treasury.

Chart courtesy of StockCharts.com

Yields on the two-year U.S. Treasury are soaring (meaning their prices are declining) and currently stand at the highest level since 2008.

Mind you, the Fed is expected to raise interest rates several times in 2018. So this could mean many more declines ahead in the bonds market.

Don’t forget that central banks around the world are following in the footsteps of the Federal Reserve. So it’s not just U.S. bondholders that could be facing losses. This could prevail across other major economies as well.

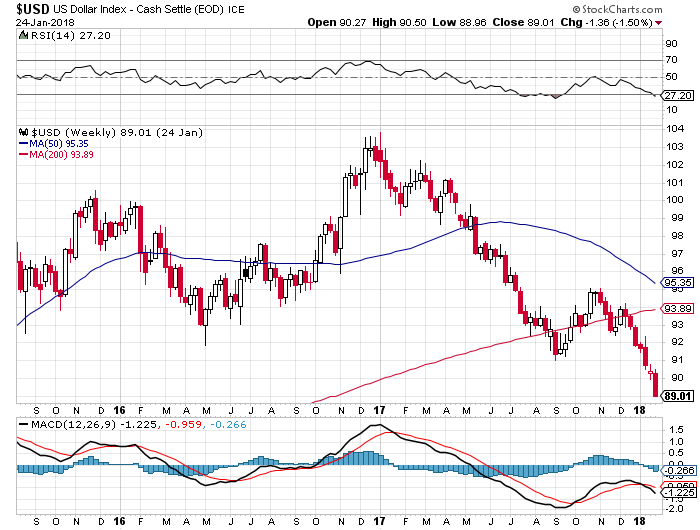

Lastly, look at the U.S. dollar. It is losing a lot of value. Since early 2017, the U.S. dollar index has declined over 13%. It currently sits at the lowest level since 2014. Just look at the chart below.

Chart courtesy of StockCharts.com

If you look at the momentum, it suggests the dollar could decline further.

Keep in mind, the U.S. dollar is the so-called “reserve currency.” If the decline in the dollar continues, there could be consequences across the world.

Where Are Gold Prices Headed Next?

Dear reader, don’t rule out a massive upside on gold prices just yet.

It is impressive to see how gold prices have done in times of no uncertainty. It will be even more interesting to watch how the precious metal performs when uncertainty comes back.

I can’t help but be bullish on the yellow metal. In the next few years, gold prices could be making a solid run toward my long-term target of $2,000. I also can’t stress this enough; at $1,250 an ounce, gold seems severely undervalued.